Avoid Phishing Scams

phone calls, text messages, and emails claiming to be from Eastern Indiana federal credit union may be fraudulent

Don't Take the Bait

Scams are on the rise. There's a new sport in town that involves some real poachers. It's called "phishing"-and the phishermen are trolling for you. Scammers are impersonating financial institutions like Eastern Indiana Federal Credit Union by making fraudulent phone calls, text messages, and emails to trick consumers into believing they are receiving legitimate calls and messages. Victims receive fraudulent emails containing authentic looking logos and familiar graphics. They often will lead to a "spoofed," or fake site that looks authentic. You're asked to divulge account information or other personal data such as usernames, passwords, and Social Security numbers. Scammers have the ability to spoof phone numbers on your caller ID.

If you receive a suspicious phone call, text message, or email from someone claiming to be from Eastern Indiana Federal Credit Union, do not respond. Always call us directly to verify.

Remember:

Eastern Indiana Federal Credit Union does not currently send out text messages asking you to verify transactions.

We will never call you to ask for your online banking username and/or password.

We will never text you to ask for your online banking username and/or password.

Create complex passwords. Use a series of upper and lowercase letters, numbers, and special characters.

Do not reuse or share your password.

Monitor your accounts. Check your balances and transaction history regularly.

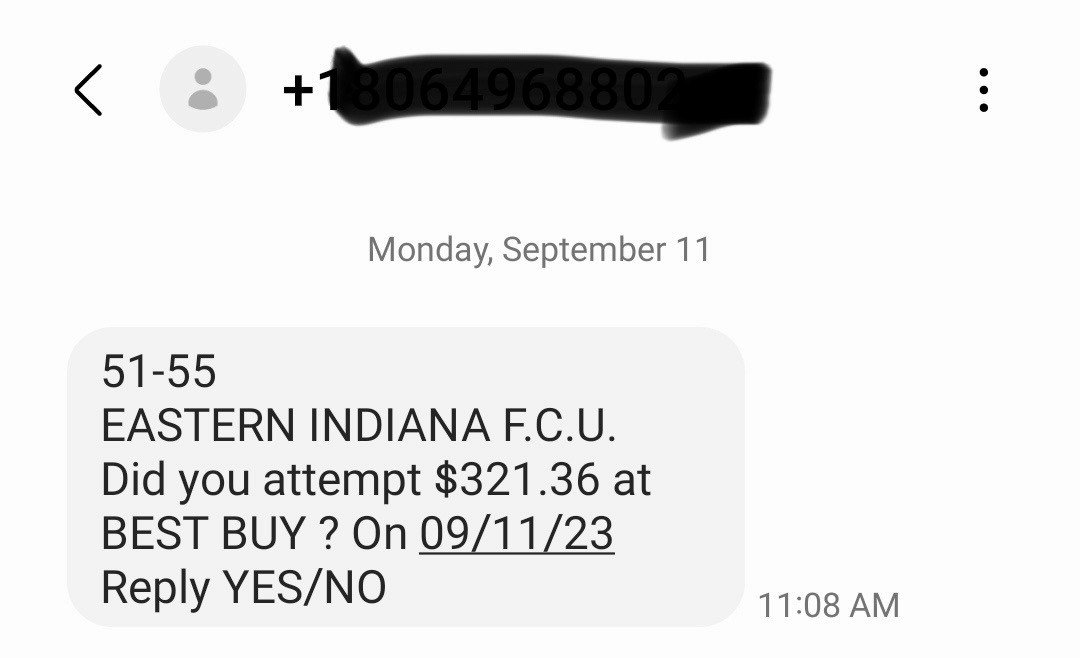

Beware of Text-Based Scams

We have received reports that fraudsters are using our name in text-based phishing scams. Eastern Indiana FCU will never send a text message requesting a reply like the one shown here. If you receive a text message like this, delete it immediately.

Here’s some additional tips to help avoid becoming the "catch" of the day:

Be a cautious Internet user.

Install a firewall as your first line of defense. This is the primary block between you and other computers on the network. Also install, run, and update antivirus and antispyware programs.

Ensure your browser is up-to-date with security patches.

Never use e-links with email to visit a Web site. Open a new browser window and type the URL (uniform resource locator) in the address bar.

Don't fill out emailed forms that ask for personal information. The only way you should send credit card or account information is via a secure Web site--you'll see https (s for secure) and the padlock icon on the browser frame; click on the lock to view the security certificate.

Be cautious of urgent emails requesting personal information. Phony emails often include upsetting or exciting statements to get people to respond. Don't. If a company or financial institution really needs to update your expired credit card number, for instance, you'll be able to take care of it the next time you make a transaction, or by a telephone call you place to the company's customer service number on the card.

Be suspicious if someone claiming to be from your financial institution asks for confidential information. This information should already be on file.

Always review statements closely. Report any suspicious activity immediately to whomever the statement is from. If you generally receive statements by mail, call the company if a statement is late to make sure an ID thief hasn't redirected your mail by changing your address.

If you have online access, monitor your accounts frequently. That assures you'll notice unauthorized transactions promptly and can take steps to prevent more transactions.

Change your online banking and shopping account passwords often--experts suggest every three to six months. If your information is caught, your passwords should be out-of-date by the time crooks try to sell the data to other phishers. Experts recommend using passwords with a combination of letters (upper and lowercase), numbers, and symbols.

Request a free copy of your credit report from the three major credit-reporting agencies-Experian (experian.com, 888-397-3742); Equifax (equifax.com, 800-685-1111); and TransUnion (transunion.com, 800-888-4213). The Fair and Accurate Credit Transactions Act (FACT Act) requires each major credit bureau to provide one free credit report annually to consumers who request a copy (annualcreditreport.com, 877-322-8228).

If you've mistakenly taken the bait, call the company that's been spoofed right away. If you're quick enough, you might be able to change your password or account number in time to stop unauthorized transactions.